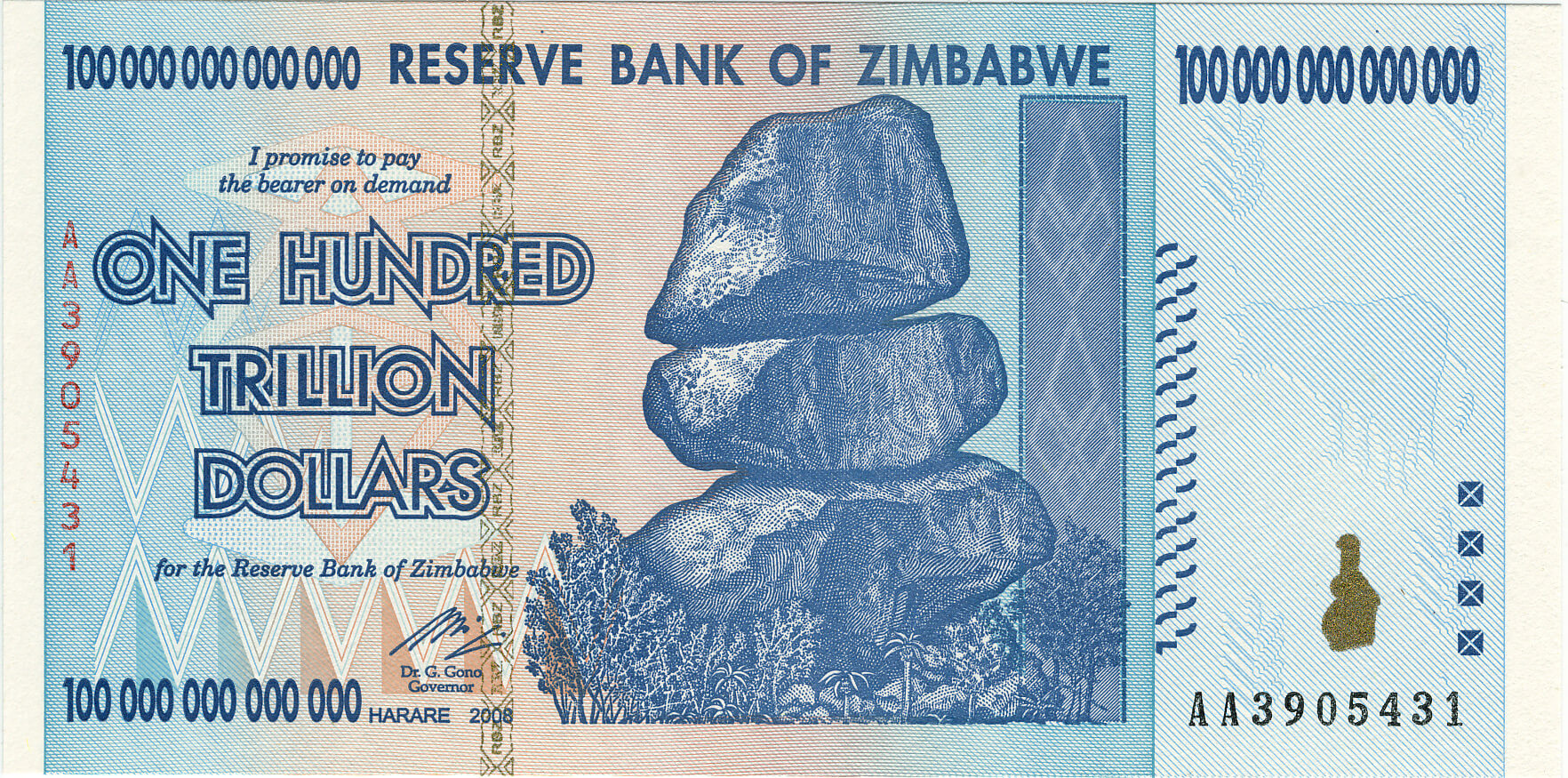

Hyperinflation of the Zimbabwe dollar turning phasing out their local money in 2015

Late in the 2000s, Zimbabwe’s economy suffered a severe downturn that set off a destructive hyperinflationary spiral that peaked in 2009. Wide-ranging effects of this economic crisis include skyrocketing prices for goods and services and a rapid depreciation of the local currency, the Zimbabwe dollar. The government launched a number of interventions in response to the dire circumstances, and ultimately decided to adopt a number of foreign currencies as legal tender in an effort to stabilize the economy. The causes and effects of Zimbabwe’s 2009 hyperinflation are explored in this article, along with the government’s response plans and the 2015 phase-out of the Zimbabwe dollar. Furthermore, it evaluates the impact of these measures on the economy and the citizens, draws lessons from the experience, and explores the future implications for Zimbabwe’s monetary policy.

The economic crisis in Zimbabwe and the 2009 hyperinflation

Southern African nation of Zimbabwe went through a severe economic crisis in the late 2000s. Hyperinflation, skyrocketing prices, and a significant drop in the standard of living for its citizens were the main characteristics of the crisis. Numerous economic issues, such as high unemployment, corruption, and unsustainable fiscal policies, were present in the nation.

Zimbabwe experienced hyperinflation in 2009, which reached astounding levels of 89.7 sextillion percent. Sextillion, you read that correctly. The Zimbabwean dollar’s value plummeted due to this uncontrollable increase in prices. Wheelbarrows full of cash were being carried by people in order to purchase even the most basic items, like bread, and an egg could cost millions of dollars. People’s life savings were destroyed, businesses were destroyed, and the country was thrown into an economic crisis as a result of hyperinflation.

Causes and consequences of the hyperinflation of the Zimbabwe dollar

Corruption and poor management were two of the main causes of Zimbabwe’s economic crisis. The collapse of agricultural production and the decline of important industries were caused by the government’s economic policies, which included excessive spending and land seizures. This, along with widespread corruption and a volatile political environment, created the ideal conditions for hyperinflation to wreck havoc on the economy.

The Zimbabwean government turned to money printing to pay for its extravagant spending, which resulted in an oversupply of new banknotes on the market. However, this only made matters worse because it set off a vicious cycle of price increases and currency devaluations. Unsustainable fiscal practices, such as excessive borrowing and a lack of fiscal restraint, fueled the hyperinflation and damaged the Zimbabwean dollar’s value.

For the people of Zimbabwe, the hyperinflationary environment had terrible consequences. The poverty rate increased as people struggled to pay for necessities. As businesses crumbled under the weight of hyperinflation, unemployment rates skyrocketed. Increased levels of poverty and economic hardship were caused by inflation, which reduced the purchasing power of wages.

Government interventions and strategies to combat hyperinflation

The Zimbabwean government implemented price controls and subsidies on necessary goods and services in an effort to combat hyperinflation. These interventions, though, frequently had the opposite effect, creating shortages and illicit trade. These actions frequently made it even more difficult for people to access basic necessities rather than stabilizing prices.

The Zimbabwe dollar was pegged to other currencies as part of the government’s efforts to stabilize the exchange rate. However, because of the underlying economic problems and lack of confidence in the local currency, these attempts were largely unsuccessful. Exchange rate volatility kept the economy from recovering and reduced the impact of government initiatives.

Zimbabwe sought international assistance and financial aid during the crisis to stabilize its economy. Organizations like the International Monetary Fund offered aid packages to help the government carry out economic reforms, providing some relief to the nation. These steps, however, were insufficient to fully address Zimbabwe’s underlying economic problems.

Introduction of multiple foreign currencies to stabilize the economy

Zimbabwe switched to using the US dollar as its main currency in 2009 in an effort to reduce hyperinflation and stabilize the economy. This choice increased stability and helped rebuild some monetary system confidence. However, it also brought about problems, such as a lack of actual US dollar bills and restricted authority over monetary policy.

Zimbabwe also added other foreign currencies, like the South African rand and the British pound, as legal tender in an effort to address the shortage of actual US dollars and diversify the country’s monetary system. This multiple-currency system gave the economy more flexibility and improved liquidity.

Initial challenges and benefits of the multi-currency system

Although the use of foreign currencies brought economic stability to Zimbabwe, it also presented difficulties. For both businesses and individuals, fluctuating exchange rates and restricted access to foreign currency created problems. A more stable economic climate and increased foreign investment were two advantages of the multi-currency system, though.

In conclusion, the Zimbabwean dollar’s hyperinflation in 2009 was a terrible incident that caused the country’s people great suffering. This crisis was exacerbated by poor economic management, money printing, and unsound fiscal policies. The government implemented a number of interventions, such as price controls and subsidies, to fight hyperinflation, but these actions were not entirely successful. In the end, the adoption of numerous foreign currencies assisted in stabilizing the economy, despite the fact that it also brought with it a unique set of difficulties.

Phasing out the Zimbabwe dollar: Reasons and challenges

The Zimbabwean government took the risky step of replacing the Zimbabwe dollar, the nation’s legal tender, with a multi-currency system in 2015. After years of hyperinflation, which had effectively rendered the Zimbabwean dollar worthless, this action was taken. The need to stabilize the economy, rebuild public confidence in the financial system, and promote foreign investment all played a role in the decision.

To combat the country’s ongoing hyperinflation, which had been a problem since the early 2000s, was one of the main justifications for the demise of the Zimbabwe dollar. Zimbabwe’s inflation peaked in 2008 at the astounding rate of 500 billion percent. A number of factors, such as excessive government spending, poor economic management, and a drop in agricultural production, contributed to this hyperinflation.

Challenges faced during the currency transition process

Zimbabwe had a difficult time making the switch from a hyperinflated currency to a multi-currency system. Ensuring a seamless exchange of the Zimbabwe dollar for other currencies was one of the biggest challenges. Daily transactions became challenging as a result of the local currency’s declining popularity and reluctance to be accepted as a form of payment by many citizens.

The logistical aspects of phased-out the Zimbabwe dollar posed another difficulty. The government had to organize the removal of the previous currency from use and the introduction of new currency in the form of coins and notes. The public needed to be informed about the new monetary system, and businesses and financial institutions needed to be adequately ready for the transition.

Public sentiment and reactions to the phasing out

Public opinion on the gradual demise of the Zimbabwean dollar was divided. Some people applauded the action because they saw it as a crucial step toward bringing about economic stability and regaining public trust in the financial system. Some people, however, were dubious and concerned about the potential annoyances and disruptions that the currency transition might bring.

Concerns were raised about how it would affect common people, especially those who relied on black market transactions using the Zimbabwean dollar. Some people were concerned that the switch to foreign currencies might result in price increases and make it more difficult for people with lower incomes to afford necessities.

Impact of the currency phasing out on the economy and citizens

The economy and people were significantly affected by the phase-out of the Zimbabwe dollar. Debt and savings were two of the main effects. During the hyperinflationary period, people who had saved money in Zimbabwean dollars saw their savings lose value. The adoption of foreign currencies brought about a sense of stability and value preservation, which helped people regain confidence in saving.

When it came to debt, borrowers who had taken out loans in Zimbabwean dollars were relieved by the transition. The burden of repaying loans in a hyperinflated currency was lifted as the local currency became obsolete. For many people and businesses, this reduced financial stress.

The phase-out of the Zimbabwean dollar contributed to greater financial stability by reestablishing trust in the banking system. People felt more secure keeping their money in banks after the introduction of foreign currencies, which helped to create a stronger and more stable financial environment.

Changes in consumer behavior and business operations

Consumer behavior and business practices both changed as a result of the currency transition. Consumers had to change their mindsets and become accustomed to exchange rates in order to use foreign currencies for regular transactions. As people looked for value for their money in a new economic environment, this change had an impact on consumer preferences and purchasing decisions.

Businesses had to adjust their pricing strategies and get used to the stability that came with using more trustworthy and widely accepted monetary units after adopting foreign currencies. Additionally, it created chances for business growth and global trade because it made doing business with foreign partners easier and more secure.

Social and political implications of the currency transition

The change in currency had broader social and political repercussions for Zimbabwe. It marked a turning point in the economic history of the nation and pointed the way toward a more open and internationally integrated economy. Greater economic ties with neighboring nations were fostered as well as opportunities for foreign investment with the shift to foreign currencies.

Politically, the decision to retire the Zimbabwean dollar showed a readiness to admit past errors and take risky actions to restore the economy. It demonstrated a dedication to drawing lessons from the hyperinflationary experiences and securing a more secure and prosperous future for the country.

The WWII Parachute Wedding Dress

Major Claude Hensinger jumped out of a B-29 bomber during World War II when the engine caught fire. He was saved by his parachute. Later, he requested that his fiancée Ruth make him a gown out of the same parachute. The dress is now on display at the Smithsonian Institute.

chand baori stepwell in Rajasthan India, Ancient cooling technique

This Chand Baori stepwell in Rajasthan, India is over 1200 years old. It’s called Chand Baori. The air at the bottom of the well is 5-6 degrees cooler than at the surface, so in addition to being a water source, it was used as a community gathering place where locals could escape the heat.

A subway in Chongqing passes through a building (images)

A train has been constructed through an apartment complex in Chongqing, China. The 19-story residential structure is not only passed by the light rail passenger train, but it also serves as a transit stop. Apartment residents can simply get a ride from the sixth to eighth levels.

Inspiring story of Emma Schols who Saved Her Six Kids From A Burning House

Emma Schols, a Swedish mother, saved all six of her children from a devastating house fire in 2019, running from room to room through flames while bleeding and losing skin. Against all odds, she survived with severe burns covering 90% of her body.

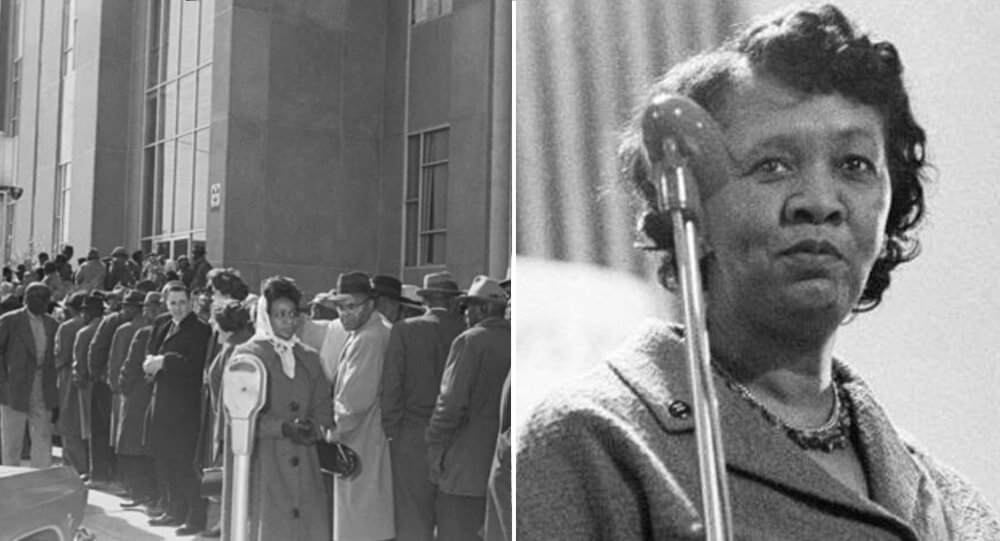

The fearless Annie Lee Cooper

Annie Lee Cooper was fired in 1963 after attempting to register to vote. She attempted it once more in 1965, but the sheriff ordered her to leave after prodding her in the neck with a club. She then punched him, causing him to fall to the ground. She was imprisoned before ultimately registering to vote. Following the passage of the Voting Rights Act, the sheriff was ousted and subsequently imprisoned for collaborating to transport drugs, but Annie Lee Cooper lived to reach 100 years old and bears her name to this day.

Woman had no idea she had an identical twin until she saw a 'lookalike' on YouTube

When Anais Bordier saw a YouTube video of Samantha Futerman, who looked exactly like her, she messaged her on Facebook and discovered they were both adopted and born on the same day. They were identical twins who had been separated at birth and had found each other by chance and on social media.

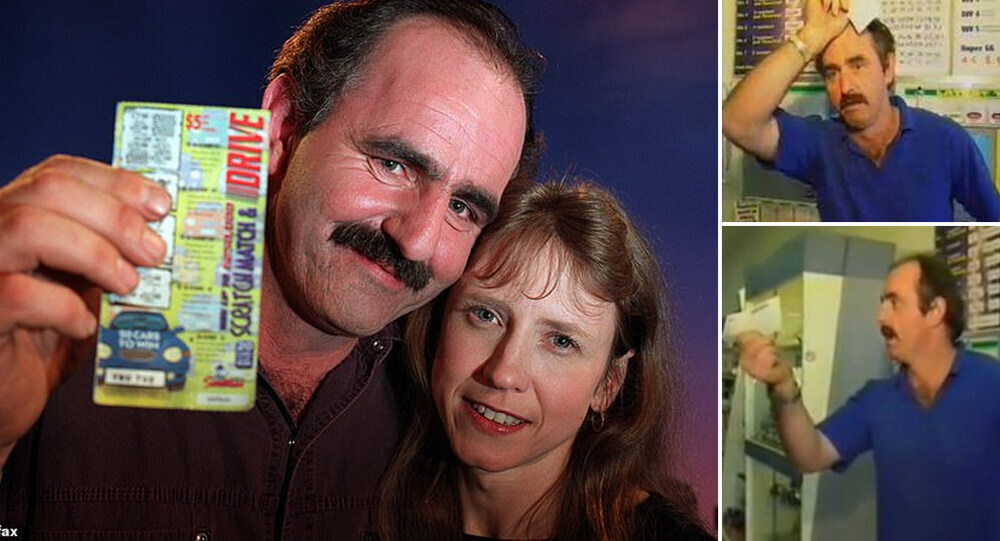

Australian man dies, comes back to life, and wins the lottery twice

Bill Morgan, an Australian, is a man who has beat the odds. He escaped death by surviving a horrific automobile accident and heart attack before collapsing into a coma and going on to win the lotto twice. He went from losing virtually everything to winning far more than he could have imagined.

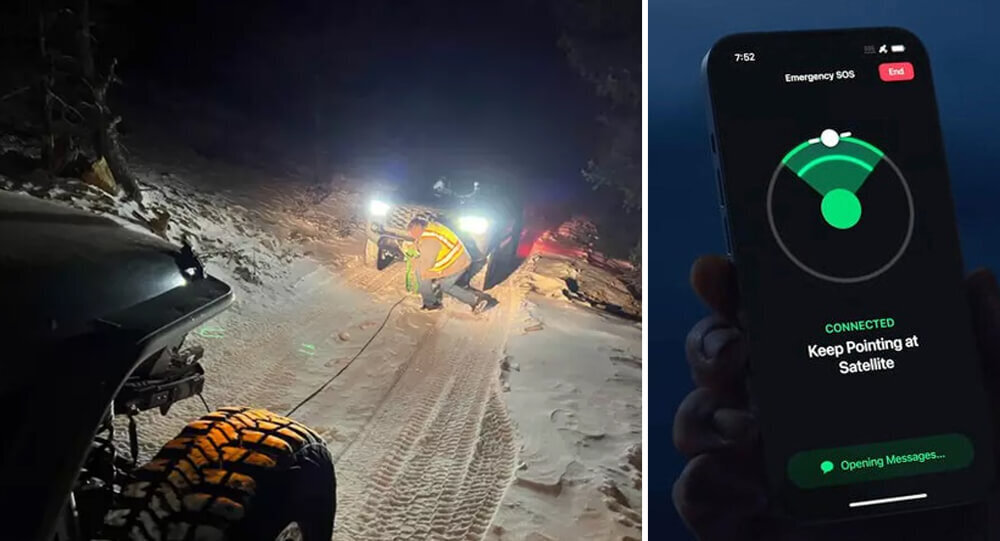

stranded hikers rescued by a life-saving iPhone feature

Stranded hikers were rescued by a life-saving iPhone feature that an awful lot of folks don't know a lot about.

New York installs first offshore wind turbine to power 70,000 homes

New York State has achieved a historic milestone in its clean energy transition by installing the first wind turbine at its first offshore wind farm, South Fork Win.

A U.S. Submarine Collides with a Japanese Fishing Ship in 2001

In 1998, 14-year-old Michael Crowe was charged with the murder of his sister. The police started targeting him after he seemed “distant and preoccupied” when his sister’s body was discovered, and during interrogation, police coercion led him to make a false confession. He was later declared factually innocent and the family won a lawsuit of $7.25 million in 2011.

Unique Dining table with a hole for your cat to peek and join you dinner.

Dinos, a Japanese internet shop, has launched a new range of cat furniture, which includes this oak table with a hole in the middle and a perch underneath. It places your cat companion in the center of the table, making your cat the main focus of your meal, as it should be, because cats are the true proprietors of “your” home.

The actions of a 7-year-old girl protected her mother from bullets

A 7-year-old girl jumped in front of her mother to save her from a man who was attempting to kill her in 2007. She was shot six times and survived, as well as saving her mother.

Smart girl saves her family more than 100 people in 2004 tsunami

In 2004, a 10-year-old girl saved her family and 100 other tourists from the Asian tsunami because she had learned about the giant waves in a geography lesson, it has emerged.

Paramedic Rescues Doctor Who Saved Him 30 Years Earlier

In 1981, a doctor helped save the life of a 3.2 pounds premature baby boy. Thirty years later, the boy, who had grown up to be a firefighter-paramedic, helped in saving the same doctor from a car accident.

Kenyan Innovator Creates Smart Gloves That Translate Sign Language Into Audible Speech

In 2023, a Kenyan inventor Roy Allela invented smart gloves that can convert sign language movements into audio speech, for his six years old niece who was born deaf.

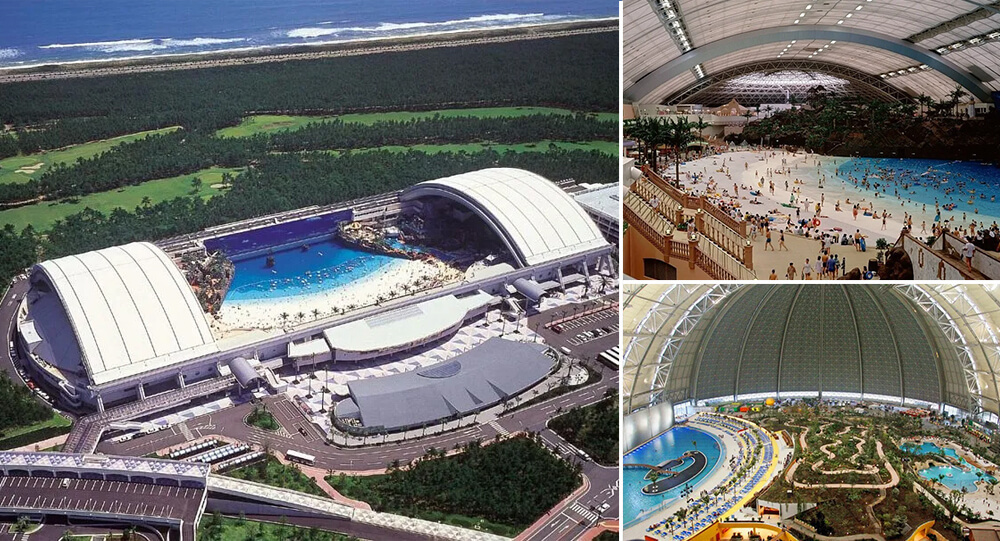

Water park in japan, ocean dome: Largest indoor water park in the world

The Seagaia Ocean Dome, located in Miyazaki, Japan, was the biggest indoor waterpark in the world. An "Ocean" six times the size of an Olympic pool, filled with 13,500 tons of unsalted, chlorinated water kept heated at 28 degrees Celsius and recognized as the largest simulated pool by the Guinness Book of World Records, measures 12,000 square meters of the sandy beach made from 600 tons of stone.

Oreo builds asteroid-proof bunker to protect its cookies and recipes

In October 2020, Oreo builds a concrete bunker in Svalbard, Norway, to protect their recipes in case of an asteroid impact. The vault also contains Oreos wrapped in Mylar and vials of milk powder.

Tourist in China left hanging from 330-ft-high glass bridge as wind blows away its panels

The popular tourist attraction glass-bottomed bridge was shattered after a strong wind blew away its panels. A Chinese tourist was left stranded in strong winds 330 feet up on a glass-bottomed bridge.

Missing Masterpiece Discovered in the Background of ‘Stuart Little’

In 2009, Gergely Barki, an art historian, was watching the film Stuart Little (1999) when he spotted an original long-lost painting used as a prop. Called Sleeping Lady with Black Vase, this painting was the work of Hungarian avant-garde painter Róbert Berény. The painting had been considered lost after World War II.

World's largest iceberg breaks off Antarctica

In 1986, the iceberg known as A23a broke away from the Antarctic coast. However, it quickly grounded in the Weddell Sea, effectively turning into an ice island.

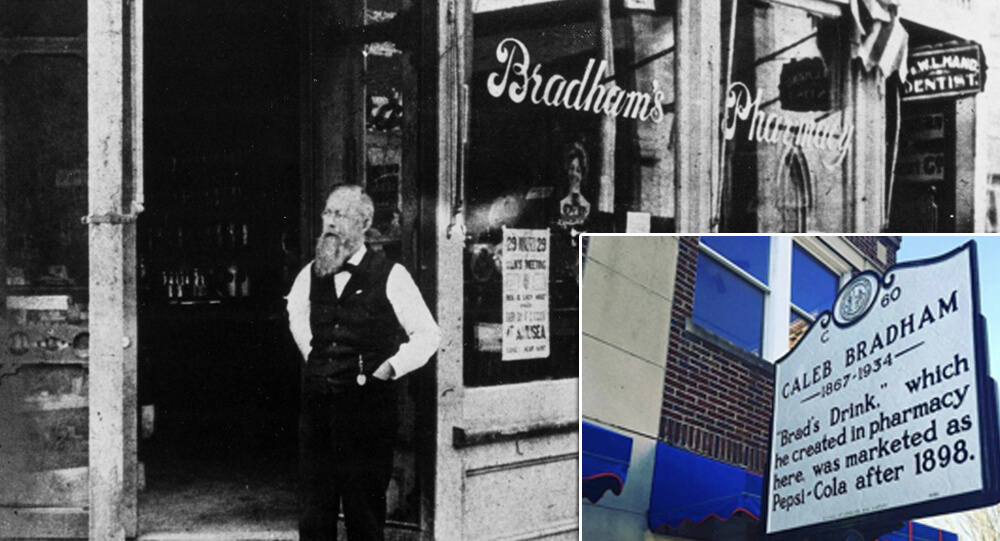

How 'Brad's Drink' Became Pepsi-Cola

Pepsi was first introduced as “Brad’s Drink” in New Bern, North Carolina, United States, in 1893 by Caleb Bradham, who made it at his drugstore where the drink was sold. It was renamed Pepsi Cola in 1898, named after the digestive enzyme pepsin and kola nuts used in the recipe.

Woman survives skydiving accident, discovers she's pregnant

2005, a woman performing her first solo skydive jump survived a parachute malfunction which caused her to slam face first into a parking lot at 50 MPH. During surgery doctors discovered she was pregnant. She made a full recovery and the baby was fine.

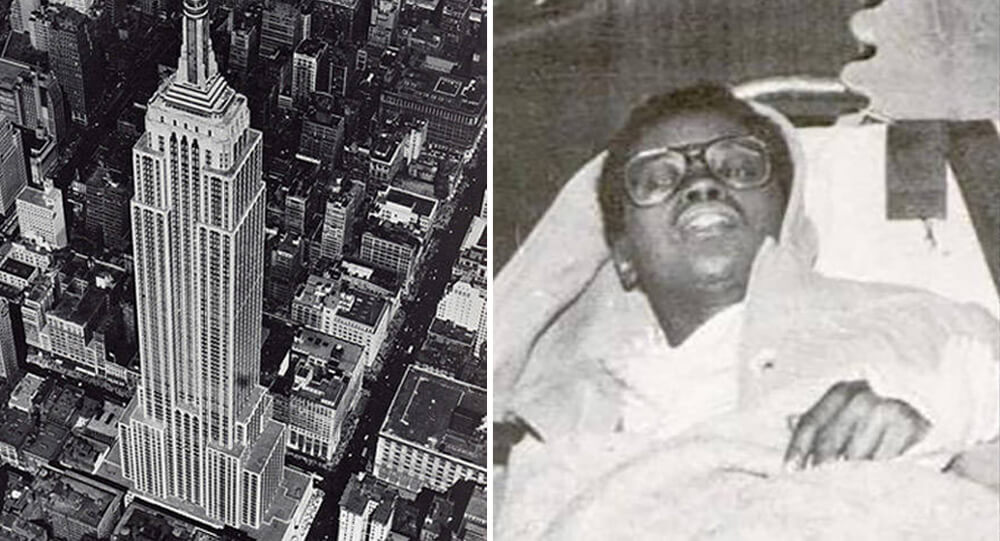

Elvita Adams jumps from the Empire State Building and amazingly survived

Elvita Adams once tried to commit suicide by jumping off the empire state building. She Jumped from the 86th floor but was blown back to 85th floor by a strong gust of wind.

China Weather Control on 2008 Olympics with missile

One thing is certain: when it comes to ensuring nice weather for the world's largest party, the Chinese cannot be accused of being subtle. The Chinese government authorized the use of 1,104 cloud seeding missile launches from 4:00-11:39 p.m. on Friday night to reduce the possibility of rain ahead of the 29th Olympic opening ceremony in Beijing

Smart guy brings life-sized cutout of his late mother to his graduation

Even though that his mother passed away in 2016, a young man had a clever idea to make a life-size cutout of her and bring it to the event so that she could attend his graduation ceremony.